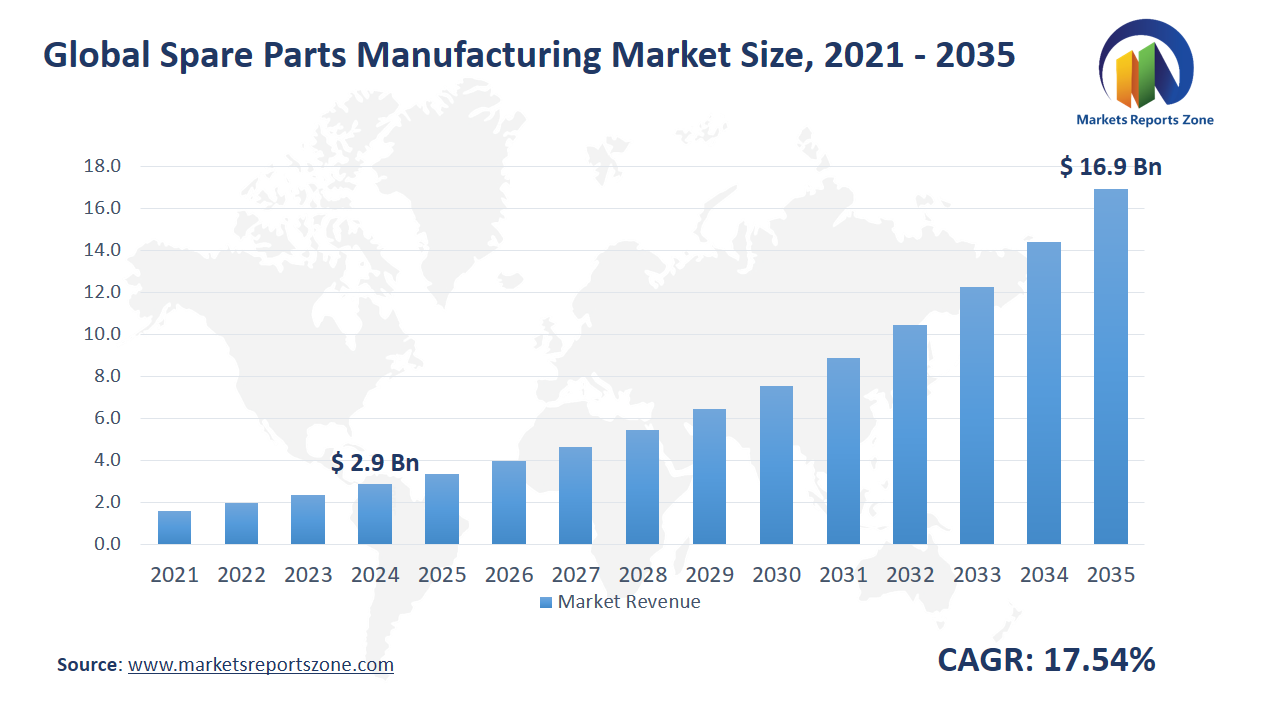

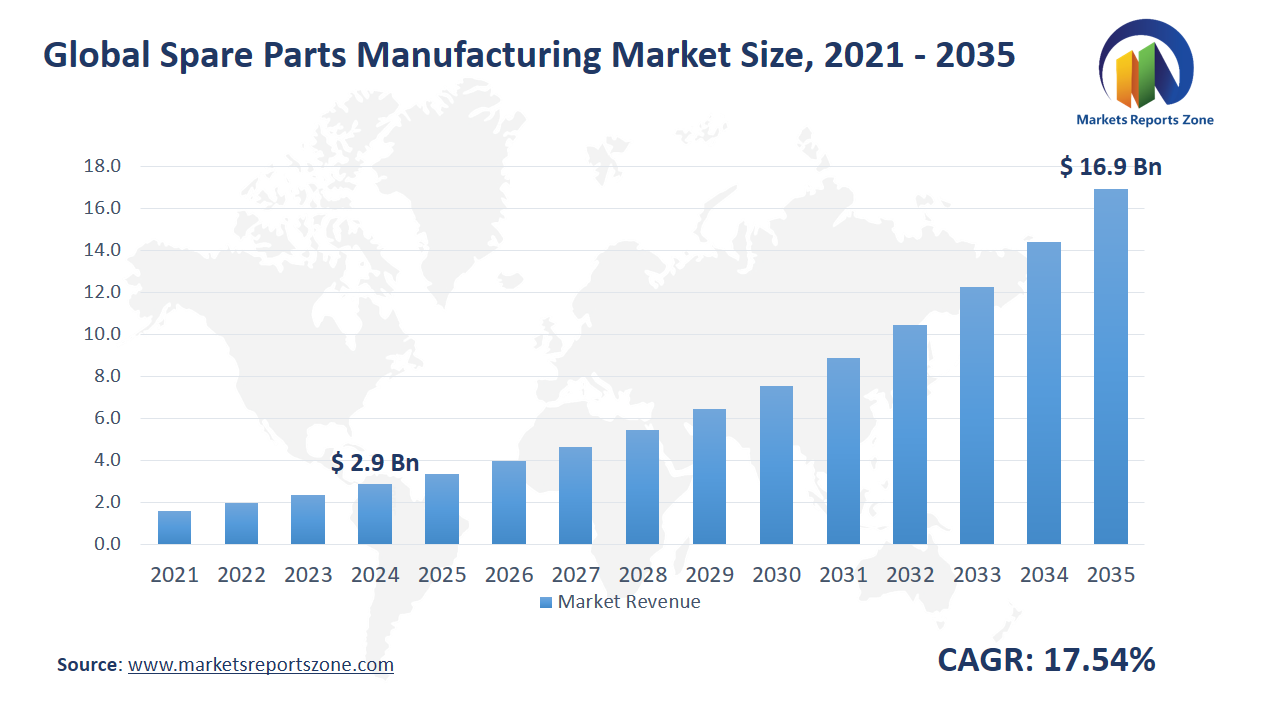

Global Spare Parts Manufacturing Market Size is expected to reach USD 16.96 Billion by 2035 from USD 2.86 Billion in 2024, with a CAGR of around 17.54% between 2024 and 2035. The global spare parts manufacturing market has been driven by increased vehicle ownership and growing industrial automation. Replacement parts have been demanded more as older vehicles have remained in use longer. In factories, machines have been upgraded frequently, which has boosted the need for customized parts. However, high raw material costs have been faced as a major restraint. Small manufacturers have been especially impacted by fluctuating metal prices and transportation challenges. Despite this, promising opportunities have been created through 3D printing technologies. Complex parts have been produced faster and with less waste. In some workshops, on-demand printing has been adopted to avoid excess inventory. Another major opportunity has been seen in the growth of e-commerce. Spare parts have been sold directly to customers through online platforms, which has cut out the need for middlemen. Rural areas have been reached more effectively with these digital models. In India, local repair shops have been empowered by online access to genuine tractor components. In Europe, aerospace companies have used predictive tools to order spare parts before failures occurred. Through innovation and digital access, the market has been reshaped. A broader customer base has been reached and more efficient solutions have been delivered across multiple industries.

Driver: Automation Demands Reliable Spare Supply

The rise of industrial automation has acted as a strong driver in the spare parts manufacturing market. As factories have embraced robotic systems and smart machinery, the need for reliable and readily available spare parts has intensified. Automated systems have been running continuously, often 24/7, increasing the wear and tear on components. To avoid downtime, manufacturers have depended on quick replacements. In Japan, electronics assembly lines have adopted predictive maintenance tools that signal when a part is about to fail, triggering an automatic order for its replacement. In Germany, automotive plants have kept local stockpiles of frequently used machine components, ensuring production lines stay uninterrupted. Even packaging industries in the U.S. have developed agreements with spare parts suppliers for express delivery of high-demand items like motor drives and servo components. These actions have ensured operational continuity. The complexity of automation has made generic replacements unsuitable, leading to a spike in demand for customized, precision-engineered parts. Companies have also started investing in digital catalogs and online platforms to make ordering faster and more accurate. With automation only expected to grow, spare parts will remain a critical support system behind the scenes, quietly keeping the industrial engine running smoothly.

Key Insights:

- Companies like Siemens have invested over $1.5 billion in modernizing manufacturing facilities to improve efficiency and meet growing demand for spare parts.

- Over 65% of spare parts manufacturers have adopted technologies like 3D printing and AI to enhance production quality and speed.

- The spare parts manufacturing industry employs over 500,000 workers globally, contributing significantly to local economies.

- Spare parts are used in nearly 92% of automotive maintenance and repair operations worldwide.

- Government Support for Innovation: Governments have provided over $500 million for research and development in spare parts manufacturing to promote innovation and sustainability.

- Countries like India export over $3.5 billion worth of automotive spare parts annually, contributing to their national economies.

- The use of advanced logistics systems has increased supply chain efficiency by over 35%, ensuring timely delivery of spare parts to industries.

- Many spare parts manufacturers have implemented eco-friendly practices, reducing waste by up to 28% and energy consumption by 18%.

Segment Analysis:

The spare parts manufacturing market is segmented by type and application, each reflecting unique demands and trends. Plastic spare parts have been used where lightweight, corrosion resistance, and cost-efficiency are required—common in consumer electronics and home appliances. For example, small appliance repair shops in urban areas of Southeast Asia have relied heavily on locally molded plastic parts for blenders and fans. On the other hand, metal spare parts have remained essential for high-stress applications, particularly in vehicles and industrial equipment. In South America, bus fleets have continued operating with the help of regionally sourced metal engine components and brake systems. By application, vehicles have driven a consistent need for spare parts due to wear-and-tear from daily use. In parts of Africa, motorbike repair garages have flourished by stocking key spares like chains, gears, and levers to meet daily commuter demand. Equipment applications have also grown steadily, especially in agricultural and construction sectors. Tractors and mixers in rural areas of Eastern Europe have been kept running through regular replacement of bearings and hydraulic components. In consumer electronics, high replacement rates of phone casings, buttons, and hinges have created steady demand for both metal and plastic parts, especially in densely populated regions where repair is favored over replacement.

Regional Analysis:

The global spare parts manufacturing market has evolved differently across regions, shaped by local industries, consumer behavior, and infrastructure. In North America, demand has been driven by the need for high-performance replacement parts in sectors like aerospace and heavy machinery. In cities across the U.S., old farm equipment has been restored using precision-engineered metal parts sourced from domestic suppliers. Europe has focused on sustainability, with spare parts playing a key role in extending the life of vehicles and appliances. In Scandinavian countries, community repair centers have gained popularity, offering workshops where citizens fix broken electronics with readily available plastic parts. Asia-Pacific has led in high-volume production and consumption, with countries like Vietnam and Thailand emerging as hubs for spare parts in electronics and motorbikes. Street-side repair stalls have offered quick fixes using mass-produced components. Latin America has seen growth in aftermarket vehicle parts, especially in older vehicle fleets that require constant maintenance. Mechanics in Argentina have commonly rebuilt engines with regionally made parts to save on costs. In the Middle East and Africa, spare parts have supported sectors like mining and transport. In Kenya, small workshops have manufactured custom parts to keep outdated construction equipment operational in remote locations.

Competitive Scenario:

Companies in the spare parts manufacturing sector have been evolving rapidly, adapting to modern demands across automotive, electronics, and industrial markets. GNA Enterprises has expanded its machining capabilities to support increased axle demand. Jayem Automotives has worked on prototyping support for electric vehicle makers, while Bosch has strengthened its focus on sensor-based spare parts for autonomous mobility. Asia Rubber & Plastics has supplied durable components for agricultural machinery, especially in Southeast Asia. Exide and Dunlop have focused on battery and tire solutions tailored for commercial fleets. CEAT has diversified its OEM contracts, supporting both utility and passenger vehicle segments. Bharat Seats and Wheels India Ltd have optimized production lines to support growing demand for ergonomic and performance-based parts. JBM Group has stepped into electric bus components, while Avtec and Hi Tech Tools have focused on high-precision engine components. Lucas TVS has introduced traction motors for electric three-wheelers, and Minda Industries has expanded its lighting and safety systems product lines. The Anand Group and Sona Koyo Steering Systems have strengthened partnerships for global supply, enhancing their role in steering and suspension systems. Collectively, these companies have driven growth by innovating with technology, supporting EV transitions, and addressing the evolving needs of manufacturers and end-users alike.

Spare Parts Manufacturing Market Report Scope

| Report Attribute | Details |

|---|

| Market Size Value in 2024 | USD 2.86 Billion |

| Revenue Forecast in 2035 | USD 16.96 Billion |

| Growth Rate | CAGR of 17.54% from 2025 to 2035 |

| Historic Period | 2021 - 2024 |

| Forecasted Period | 2025 - 2035 |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | U.S.; Canada; Mexico, UK; Germany; France; Spain; Italy; Russia; China; Japan; India; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

| Key companies profiled | GNA Enterprises; Spare Parts Manufacturing; Gemsons; Jayem Automotives; SCL; Bosch; Asia Rubber & Plastics; Exide; Dunlop; CEAT; Bharat Seats; JBM Group; Gayatri Industries; Wheels India Ltd; Avtec; Hi Tech Tools Company; Lucas TVS; Minda Industries; Anand Group; Sona Koyo Steering Systems |

| Customization | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

The Global Spare Parts Manufacturing Market report is segmented as follows:

By Type,

- Plastic Spare Parts

- Metal Spare Parts

By Application,

- Vehicle

- Equipment

- Consumer Electronics

By Region,

- North America

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East and Africa

Key Market Players,

- GNA Enterprises

- Spare Parts Manufacturing

- Gemsons

- Jayem Automotives

- SCL

- Bosch

- Asia Rubber & Plastics

- Exide

- Dunlop

- CEAT

- Bharat Seats

- JBM Group

- Gayatri Industries

- Wheels India Ltd

- Avtec

- Hi Tech Tools Company

- Lucas TVS

- Minda Industries

- Anand Group

- Sona Koyo Steering Systems

Frequently Asked Questions

Global Spare Parts Manufacturing Market Size was valued at USD 2.86 Billion in 2024 and is projected to reach at USD 16.96 Billion in 2035.

Global Spare Parts Manufacturing Market is expected to grow at a CAGR of around 17.54% during the forecasted year.

North America, Asia Pacific and Europe are major regions in the global Spare Parts Manufacturing Market.

Key players analyzed in the global Spare Parts Manufacturing Market are GNA Enterprises; Spare Parts Manufacturing; Gemsons; Jayem Automotives; SCL; Bosch; Asia Rubber & Plastics; Exide; Dunlop; CEAT; Bharat Seats; JBM Group; Gayatri Industries; Wheels India Ltd; Avtec; Hi Tech Tools Company; Lucas TVS; Minda Industries; Anand Group; Sona Koyo Steering Systems and so on.

Research Objectives

- Proliferation and maturation of trade in the global Spare Parts Manufacturing Market.

- The market share of the global Spare Parts Manufacturing Market, supply and demand ratio, growth revenue, supply chain analysis, and business overview.

- Current and future market trends that are influencing the growth opportunities and growth rate of the global Spare Parts Manufacturing Market.

- Feasibility study, new market insights, company profiles, investment return, market size of the global Spare Parts Manufacturing Market.

Chapter 1 Spare Parts Manufacturing Market Executive Summary

- 1.1 Spare Parts Manufacturing Market Research Scope

- 1.2 Spare Parts Manufacturing Market Estimates and Forecast (2021-2035)

- 1.2.1 Global Spare Parts Manufacturing Market Value and Growth Rate (2021-2035)

- 1.2.2 Global Spare Parts Manufacturing Market Price Trend (2021-2035)

- 1.3 Global Spare Parts Manufacturing Market Value Comparison, by Type (2021-2035)

- 1.3.1 Plastic Spare Parts

- 1.3.2 Metal Spare Parts

- 1.4 Global Spare Parts Manufacturing Market Value Comparison, by Application (2021-2035)

- 1.4.1 Vehicle

- 1.4.2 Equipment

- 1.4.3 Consumer Electronics

Chapter 2 Research Methodology

- 2.1 Introduction

- 2.2 Data Capture Sources

- 2.2.1 Primary Sources

- 2.2.2 Secondary Sources

- 2.3 Market Size Estimation

- 2.4 Market Forecast

- 2.5 Assumptions and Limitations

Chapter 3 Market Dynamics

- 3.1 Market Trends

- 3.2 Opportunities and Drivers

- 3.3 Challenges

- 3.4 Market Restraints

- 3.5 Porter's Five Forces Analysis

Chapter 4 Supply Chain Analysis and Marketing Channels

- 4.1 Spare Parts Manufacturing Supply Chain Analysis

- 4.2 Marketing Channels

- 4.3 Spare Parts Manufacturing Suppliers List

- 4.4 Spare Parts Manufacturing Distributors List

- 4.5 Spare Parts Manufacturing Customers

Chapter 5 COVID-19 & Russia?Ukraine War Impact Analysis

- 5.1 COVID-19 Impact Analysis on Spare Parts Manufacturing Market

- 5.2 Russia-Ukraine War Impact Analysis on Spare Parts Manufacturing Market

Chapter 6 Spare Parts Manufacturing Market Estimate and Forecast by Region

- 6.1 Global Spare Parts Manufacturing Market Value by Region: 2021 VS 2023 VS 2035

- 6.2 Global Spare Parts Manufacturing Market Scenario by Region (2021-2023)

- 6.2.1 Global Spare Parts Manufacturing Market Value Share by Region (2021-2023)

- 6.3 Global Spare Parts Manufacturing Market Forecast by Region (2024-2035)

- 6.3.1 Global Spare Parts Manufacturing Market Value Forecast by Region (2024-2035)

- 6.4 Geographic Market Analysis: Market Facts and Figures

- 6.4.1 North America Spare Parts Manufacturing Market Estimates and Projections (2021-2035)

- 6.4.2 Europe Spare Parts Manufacturing Market Estimates and Projections (2021-2035)

- 6.4.3 Asia Pacific Spare Parts Manufacturing Market Estimates and Projections (2021-2035)

- 6.4.4 Latin America Spare Parts Manufacturing Market Estimates and Projections (2021-2035)

- 6.4.5 Middle East & Africa Spare Parts Manufacturing Market Estimates and Projections (2021-2035)

Chapter 7 Global Spare Parts Manufacturing Competition Landscape by Players

- 7.1 Global Top Spare Parts Manufacturing Players by Value (2021-2023)

- 7.2 Spare Parts Manufacturing Headquarters and Sales Region by Company

- 7.3 Company Recent Developments, Mergers & Acquisitions, and Expansion Plans

Chapter 8 Global Spare Parts Manufacturing Market, by Type

- 8.1 Global Spare Parts Manufacturing Market Value, by Type (2021-2035)

- 8.1.1 Plastic Spare Parts

- 8.1.2 Metal Spare Parts

Chapter 9 Global Spare Parts Manufacturing Market, by Application

- 9.1 Global Spare Parts Manufacturing Market Value, by Application (2021-2035)

- 9.1.1 Vehicle

- 9.1.2 Equipment

- 9.1.3 Consumer Electronics

Chapter 10 North America Spare Parts Manufacturing Market

- 10.1 Overview

- 10.2 North America Spare Parts Manufacturing Market Value, by Country (2021-2035)

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 North America Spare Parts Manufacturing Market Value, by Type (2021-2035)

- 10.3.1 Plastic Spare Parts

- 10.3.2 Metal Spare Parts

- 10.4 North America Spare Parts Manufacturing Market Value, by Application (2021-2035)

- 10.4.1 Vehicle

- 10.4.2 Equipment

- 10.4.3 Consumer Electronics

Chapter 11 Europe Spare Parts Manufacturing Market

- 11.1 Overview

- 11.2 Europe Spare Parts Manufacturing Market Value, by Country (2021-2035)

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Spain

- 11.2.5 Italy

- 11.2.6 Russia

- 11.2.7 Rest of Europe

- 11.3 Europe Spare Parts Manufacturing Market Value, by Type (2021-2035)

- 11.3.1 Plastic Spare Parts

- 11.3.2 Metal Spare Parts

- 11.4 Europe Spare Parts Manufacturing Market Value, by Application (2021-2035)

- 11.4.1 Vehicle

- 11.4.2 Equipment

- 11.4.3 Consumer Electronics

Chapter 12 Asia Pacific Spare Parts Manufacturing Market

- 12.1 Overview

- 12.2 Asia Pacific Spare Parts Manufacturing Market Value, by Country (2021-2035)

- 12.2.1 China

- 12.2.2 Japan

- 12.2.3 India

- 12.2.4 South Korea

- 12.2.5 Australia

- 12.2.6 Southeast Asia

- 12.2.7 Rest of Asia Pacific

- 12.3 Asia Pacific Spare Parts Manufacturing Market Value, by Type (2021-2035)

- 12.3.1 Plastic Spare Parts

- 12.3.2 Metal Spare Parts

- 12.4 Asia Pacific Spare Parts Manufacturing Market Value, by Application (2021-2035)

- 12.4.1 Vehicle

- 12.4.2 Equipment

- 12.4.3 Consumer Electronics

Chapter 13 Latin America Spare Parts Manufacturing Market

- 13.1 Overview

- 13.2 Latin America Spare Parts Manufacturing Market Value, by Country (2021-2035)

- 13.2.1 Brazil

- 13.2.2 Argentina

- 13.2.3 Rest of Latin America

- 13.3 Latin America Spare Parts Manufacturing Market Value, by Type (2021-2035)

- 13.3.1 Plastic Spare Parts

- 13.3.2 Metal Spare Parts

- 13.4 Latin America Spare Parts Manufacturing Market Value, by Application (2021-2035)

- 13.4.1 Vehicle

- 13.4.2 Equipment

- 13.4.3 Consumer Electronics

Chapter 14 Middle East & Africa Spare Parts Manufacturing Market

- 14.1 Overview

- 14.2 Middle East & Africa Spare Parts Manufacturing Market Value, by Country (2021-2035)

- 14.2.1 Saudi Arabia

- 14.2.2 UAE

- 14.2.3 South Africa

- 14.2.4 Rest of Middle East & Africa

- 14.3 Middle East & Africa Spare Parts Manufacturing Market Value, by Type (2021-2035)

- 14.3.1 Plastic Spare Parts

- 14.3.2 Metal Spare Parts

- 14.4 Middle East & Africa Spare Parts Manufacturing Market Value, by Application (2021-2035)

- 14.4.1 Vehicle

- 14.4.2 Equipment

- 14.4.3 Consumer Electronics

Chapter 15 Company Profiles and Market Share Analysis: (Business Overview, Market Share Analysis, Products/Services Offered, Recent Developments)

- 15.1 GNA Enterprises

- 15.2 Spare Parts Manufacturing

- 15.3 Gemsons

- 15.4 Jayem Automotives

- 15.5 SCL

- 15.6 Bosch

- 15.7 Asia Rubber & Plastics

- 15.8 Exide

- 15.9 Dunlop

- 15.10 CEAT

- 15.11 Bharat Seats

- 15.12 JBM Group

- 15.13 Gayatri Industries

- 15.14 Wheels India Ltd

- 15.15 Avtec

- 15.16 Hi Tech Tools Company

- 15.17 Lucas TVS

- 15.18 Minda Industries

- 15.19 Anand Group

- 15.20 Sona Koyo Steering Systems