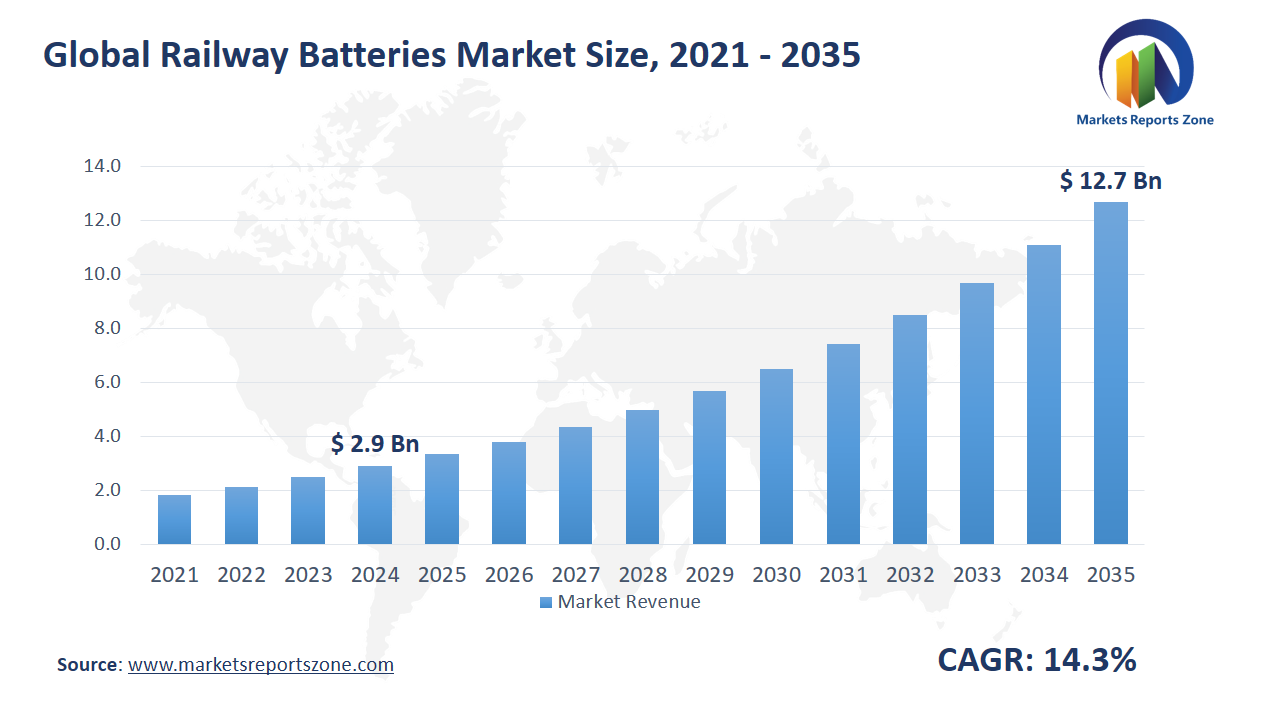

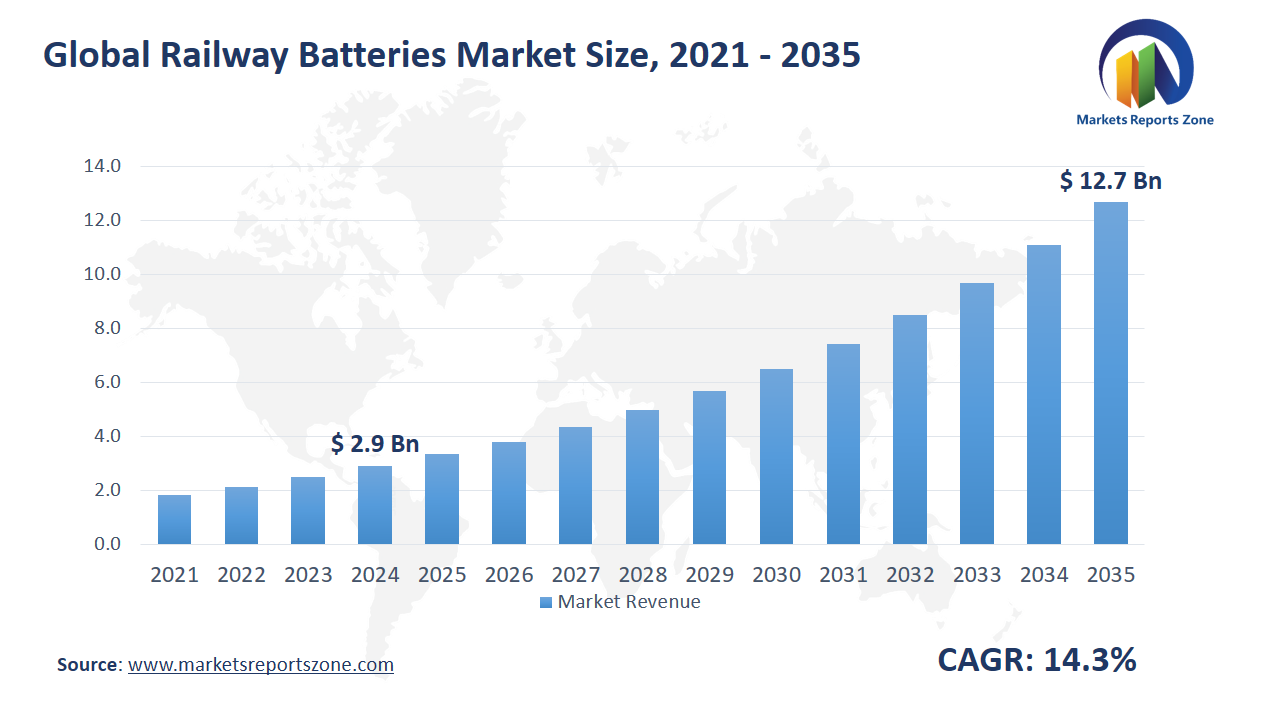

Global Railway Batteries Market Size is expected to reach USD 12.69 Billion by 2035 from USD 2.91 Billion in 2024, with a CAGR of around 14.3% between 2024 and 2035. The global railway batteries market is driven by the increasing adoption of electric trains and the growing focus on sustainable transportation. Rising investments in railway electrification are boosting the demand for reliable and long-lasting batteries. The shift toward reducing carbon emissions is also driving the use of battery-powered trains in place of diesel locomotives. However, the high cost of advanced railway batteries acts as a major restraint, limiting adoption by smaller operators. Despite this, significant opportunities exist. The growing trend of hybrid trains is creating demand for energy-efficient battery systems that enhance performance and reduce fuel consumption. Additionally, advancements in lithium-ion technology are enabling the development of lightweight, high-capacity batteries, making them ideal for high-speed and long-distance trains. For instance, the Indian Railways is using battery-powered shunting locomotives to reduce fuel dependency and operating costs. Similarly, in Germany, battery-electric trains are being deployed on non-electrified tracks, cutting emissions and enhancing efficiency. As governments and railway operators prioritize green transportation, the demand for efficient and durable railway batteries is expected to rise, making them essential for the future of eco-friendly rail networks.

Driver: Rail Electrification Driving Battery Demand

The growing adoption of electric trains is significantly boosting the demand for railway batteries. As governments and rail operators focus on reducing carbon emissions, electrified rail networks are expanding rapidly. To support this shift, high-performance batteries are being used for backup power, auxiliary systems, and hybrid operations. Electric trains rely on advanced battery technology to provide consistent power during voltage fluctuations and ensure safe operations during emergencies. For example, France’s national railway operator is deploying battery-electric trains on partially electrified routes, reducing the need for diesel engines. In Japan, bullet trains are equipped with lithium-ion backup batteries, allowing them to continue operating during power outages, enhancing passenger safety. The rise of hybrid locomotives, which combine battery and electric power, is further driving demand. These trains reduce fuel consumption by switching to battery mode during low-speed operations or in emission-restricted zones. In urban areas, light rail systems are increasingly using battery-powered trams to eliminate the need for overhead wires, preserving city aesthetics. As more countries invest in railway electrification, the need for efficient, durable, and high-capacity batteries is expected to grow, making them essential for modern rail infrastructure.

Key Insights:

- The adoption rate of railway batteries in electric and hybrid trains is approximately 70%.

- In 2024, the Indian government announced an investment of USD 1.2 billion for the electrification of railway lines to enhance sustainability.

- The number of railway battery units sold globally in 2023 was around 500,000 units.

- The penetration rate of battery systems in urban rail transit is estimated to be about 60%.

- In 2024, a consortium of European rail companies invested USD 500 million in developing advanced battery technologies for high-speed trains.

- The average annual growth rate of the railway battery market is projected to be around 5% over the next five years.

- The demand for lithium-ion batteries in the railway sector is expected to increase by 20% annually due to advancements in battery technology.

- Government initiatives across various countries aim to reduce carbon emissions from rail transport, with a target of achieving a 30% reduction by 2030 through increased battery adoption.

Segment Analysis:

The global railway batteries market is segmented by type and application, catering to various rail operations. Lead-acid batteries are widely used for backup power in locomotives and railroad signaling systems due to their cost-effectiveness and reliability. For instance, freight trains use lead-acid batteries to power emergency lighting and safety systems during power failures. Lithium-ion (Li-Ion) batteries are gaining popularity in modern rail systems due to their higher energy density, faster charging, and longer lifespan. These batteries are increasingly used in rapid-transit vehicles, such as metro trains, to support regenerative braking systems and reduce energy consumption. Nickel-cadmium (Ni-Cd) batteries are favored for their durability and ability to perform in extreme temperatures. They are commonly used in high-speed trains, providing stable power for onboard electronics and auxiliary systems. On the application side, locomotives rely on batteries for engine starting, lighting, and backup power. Rapid-transit vehicles, such as trams and electric multiple units (EMUs), use advanced batteries to enhance energy efficiency and reduce reliance on external power sources. Railroad cars utilize batteries for air conditioning, lighting, and braking systems, ensuring consistent passenger comfort. As rail networks expand and modernize, the demand for efficient and durable railway batteries is steadily increasing.

Regional Analysis:

The global railway batteries market is witnessing growth across regions, driven by expanding rail infrastructure and rising investments in sustainable transportation. North America is seeing increased demand due to the expansion of electric commuter trains. For example, U.S. rail operators are deploying battery-powered locomotives on short-haul routes to reduce diesel dependence. In Europe, the push for green transportation is accelerating the adoption of battery-electric trains. Countries like the UK are introducing hybrid trains with battery systems to operate on non-electrified tracks, lowering emissions. The Asia-Pacific region is experiencing rapid growth, driven by high-speed rail projects. In China, battery-powered trains are being deployed on urban transit networks, enhancing energy efficiency. Latin America is witnessing rising demand as governments modernize their railway systems. For instance, electric commuter trains in Mexico use onboard batteries for auxiliary power, ensuring uninterrupted operations. In the Middle East and Africa, the focus on public transportation development is driving adoption. Battery-powered light rail vehicles in Saudi Arabia are being introduced to reduce fuel consumption and emissions. As governments worldwide invest in railway modernization and electrification, the demand for efficient and long-lasting railway batteries is steadily rising across all regions.

Competitive Scenario:

Leading companies in the global railway batteries market are driving growth through technological advancements, product expansion, and strategic collaborations. EnerSys is expanding its portfolio by developing high-capacity lithium-ion batteries designed for hybrid and electric trains, enhancing efficiency and range. Exide India Limited is focusing on lead-acid battery innovation, introducing longer-lasting and maintenance-free models for locomotives and rapid-transit vehicles. HBL is strengthening its presence in the railway sector by offering nickel-cadmium (Ni-Cd) batteries with improved durability, catering to extreme weather conditions. Saft is investing in advanced lithium-ion battery technology, launching lightweight and high-energy-density solutions for high-speed and urban rail systems. Amara Raja is expanding its production capacity, introducing next-generation railway batteries with enhanced power retention for improved backup performance. GS Yuasa is developing fast-charging lithium-ion batteries, enabling electric trains to operate on partially electrified routes without interruptions. Hoppecke is innovating with modular battery systems, allowing flexible energy storage configurations for various rail applications. As companies prioritize energy efficiency, safety, and reliability, the market is witnessing the introduction of more durable, high-performance railway batteries. With ongoing technological advancements, these companies are helping transform the railway sector with cleaner, more efficient, and sustainable energy solutions.

Railway Batteries Market Report Scope

| Report Attribute | Details |

|---|

| Market Size Value in 2024 | USD 2.91 Billion |

| Revenue Forecast in 2035 | USD 12.69 Billion |

| Growth Rate | CAGR of 14.3% from 2025 to 2035 |

| Historic Period | 2021 - 2024 |

| Forecasted Period | 2025 - 2035 |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | U.S.; Canada; Mexico, UK; Germany; France; Spain; Italy; Russia; China; Japan; India; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

| Key companies profiled | EnerSys; Exide India Limited; HBL; Saft; Amara Raja; GS Yuasa; Hoppecke |

| Customization | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

The Global Railway Batteries Market report is segmented as follows:

By Type,

- Lead-Acid

- Li-Ion (Lithium-Ion)

- Ni-Cd (Nickel-Cadmium)

By Application,

- Locomotives

- Rapid-Transit Vehicles

- Railroad Cars

By Region,

- North America

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East and Africa

Key Market Players,

Frequently Asked Questions

Global Railway Batteries Market Size was valued at USD 2.91 Billion in 2024 and is projected to reach at USD 12.69 Billion in 2035.

Global Railway Batteries Market is expected to grow at a CAGR of around 14.3% during the forecasted year.

North America, Asia Pacific and Europe are major regions in the global Railway Batteries Market.

Key players analyzed in the global Railway Batteries Market are EnerSys; Exide India Limited; HBL; Saft; Amara Raja; GS Yuasa; Hoppecke and so on.

Research Objectives

- Proliferation and maturation of trade in the global Railway Batteries Market.

- The market share of the global Railway Batteries Market, supply and demand ratio, growth revenue, supply chain analysis, and business overview.

- Current and future market trends that are influencing the growth opportunities and growth rate of the global Railway Batteries Market.

- Feasibility study, new market insights, company profiles, investment return, market size of the global Railway Batteries Market.

Chapter 1 Railway Batteries Market Executive Summary

- 1.1 Railway Batteries Market Research Scope

- 1.2 Railway Batteries Market Estimates and Forecast (2021-2035)

- 1.2.1 Global Railway Batteries Market Value and Growth Rate (2021-2035)

- 1.2.2 Global Railway Batteries Market Price Trend (2021-2035)

- 1.3 Global Railway Batteries Market Value Comparison, by Type (2021-2035)

- 1.3.1 Lead-Acid

- 1.3.2 Li-Ion (Lithium-Ion)

- 1.3.3 Ni-Cd (Nickel-Cadmium)

- 1.4 Global Railway Batteries Market Value Comparison, by Application (2021-2035)

- 1.4.1 Locomotives

- 1.4.2 Rapid-Transit Vehicles

- 1.4.3 Railroad Cars

Chapter 2 Research Methodology

- 2.1 Introduction

- 2.2 Data Capture Sources

- 2.2.1 Primary Sources

- 2.2.2 Secondary Sources

- 2.3 Market Size Estimation

- 2.4 Market Forecast

- 2.5 Assumptions and Limitations

Chapter 3 Market Dynamics

- 3.1 Market Trends

- 3.2 Opportunities and Drivers

- 3.3 Challenges

- 3.4 Market Restraints

- 3.5 Porter's Five Forces Analysis

Chapter 4 Supply Chain Analysis and Marketing Channels

- 4.1 Railway Batteries Supply Chain Analysis

- 4.2 Marketing Channels

- 4.3 Railway Batteries Suppliers List

- 4.4 Railway Batteries Distributors List

- 4.5 Railway Batteries Customers

Chapter 5 COVID-19 & Russia?Ukraine War Impact Analysis

- 5.1 COVID-19 Impact Analysis on Railway Batteries Market

- 5.2 Russia-Ukraine War Impact Analysis on Railway Batteries Market

Chapter 6 Railway Batteries Market Estimate and Forecast by Region

- 6.1 Global Railway Batteries Market Value by Region: 2021 VS 2023 VS 2035

- 6.2 Global Railway Batteries Market Scenario by Region (2021-2023)

- 6.2.1 Global Railway Batteries Market Value Share by Region (2021-2023)

- 6.3 Global Railway Batteries Market Forecast by Region (2024-2035)

- 6.3.1 Global Railway Batteries Market Value Forecast by Region (2024-2035)

- 6.4 Geographic Market Analysis: Market Facts and Figures

- 6.4.1 North America Railway Batteries Market Estimates and Projections (2021-2035)

- 6.4.2 Europe Railway Batteries Market Estimates and Projections (2021-2035)

- 6.4.3 Asia Pacific Railway Batteries Market Estimates and Projections (2021-2035)

- 6.4.4 Latin America Railway Batteries Market Estimates and Projections (2021-2035)

- 6.4.5 Middle East & Africa Railway Batteries Market Estimates and Projections (2021-2035)

Chapter 7 Global Railway Batteries Competition Landscape by Players

- 7.1 Global Top Railway Batteries Players by Value (2021-2023)

- 7.2 Railway Batteries Headquarters and Sales Region by Company

- 7.3 Company Recent Developments, Mergers & Acquisitions, and Expansion Plans

Chapter 8 Global Railway Batteries Market, by Type

- 8.1 Global Railway Batteries Market Value, by Type (2021-2035)

- 8.1.1 Lead-Acid

- 8.1.2 Li-Ion (Lithium-Ion)

- 8.1.3 Ni-Cd (Nickel-Cadmium)

Chapter 9 Global Railway Batteries Market, by Application

- 9.1 Global Railway Batteries Market Value, by Application (2021-2035)

- 9.1.1 Locomotives

- 9.1.2 Rapid-Transit Vehicles

- 9.1.3 Railroad Cars

Chapter 10 North America Railway Batteries Market

- 10.1 Overview

- 10.2 North America Railway Batteries Market Value, by Country (2021-2035)

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 North America Railway Batteries Market Value, by Type (2021-2035)

- 10.3.1 Lead-Acid

- 10.3.2 Li-Ion (Lithium-Ion)

- 10.3.3 Ni-Cd (Nickel-Cadmium)

- 10.4 North America Railway Batteries Market Value, by Application (2021-2035)

- 10.4.1 Locomotives

- 10.4.2 Rapid-Transit Vehicles

- 10.4.3 Railroad Cars

Chapter 11 Europe Railway Batteries Market

- 11.1 Overview

- 11.2 Europe Railway Batteries Market Value, by Country (2021-2035)

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Spain

- 11.2.5 Italy

- 11.2.6 Russia

- 11.2.7 Rest of Europe

- 11.3 Europe Railway Batteries Market Value, by Type (2021-2035)

- 11.3.1 Lead-Acid

- 11.3.2 Li-Ion (Lithium-Ion)

- 11.3.3 Ni-Cd (Nickel-Cadmium)

- 11.4 Europe Railway Batteries Market Value, by Application (2021-2035)

- 11.4.1 Locomotives

- 11.4.2 Rapid-Transit Vehicles

- 11.4.3 Railroad Cars

Chapter 12 Asia Pacific Railway Batteries Market

- 12.1 Overview

- 12.2 Asia Pacific Railway Batteries Market Value, by Country (2021-2035)

- 12.2.1 China

- 12.2.2 Japan

- 12.2.3 India

- 12.2.4 South Korea

- 12.2.5 Australia

- 12.2.6 Southeast Asia

- 12.2.7 Rest of Asia Pacific

- 12.3 Asia Pacific Railway Batteries Market Value, by Type (2021-2035)

- 12.3.1 Lead-Acid

- 12.3.2 Li-Ion (Lithium-Ion)

- 12.3.3 Ni-Cd (Nickel-Cadmium)

- 12.4 Asia Pacific Railway Batteries Market Value, by Application (2021-2035)

- 12.4.1 Locomotives

- 12.4.2 Rapid-Transit Vehicles

- 12.4.3 Railroad Cars

Chapter 13 Latin America Railway Batteries Market

- 13.1 Overview

- 13.2 Latin America Railway Batteries Market Value, by Country (2021-2035)

- 13.2.1 Brazil

- 13.2.2 Argentina

- 13.2.3 Rest of Latin America

- 13.3 Latin America Railway Batteries Market Value, by Type (2021-2035)

- 13.3.1 Lead-Acid

- 13.3.2 Li-Ion (Lithium-Ion)

- 13.3.3 Ni-Cd (Nickel-Cadmium)

- 13.4 Latin America Railway Batteries Market Value, by Application (2021-2035)

- 13.4.1 Locomotives

- 13.4.2 Rapid-Transit Vehicles

- 13.4.3 Railroad Cars

Chapter 14 Middle East & Africa Railway Batteries Market

- 14.1 Overview

- 14.2 Middle East & Africa Railway Batteries Market Value, by Country (2021-2035)

- 14.2.1 Saudi Arabia

- 14.2.2 UAE

- 14.2.3 South Africa

- 14.2.4 Rest of Middle East & Africa

- 14.3 Middle East & Africa Railway Batteries Market Value, by Type (2021-2035)

- 14.3.1 Lead-Acid

- 14.3.2 Li-Ion (Lithium-Ion)

- 14.3.3 Ni-Cd (Nickel-Cadmium)

- 14.4 Middle East & Africa Railway Batteries Market Value, by Application (2021-2035)

- 14.4.1 Locomotives

- 14.4.2 Rapid-Transit Vehicles

- 14.4.3 Railroad Cars

Chapter 15 Company Profiles and Market Share Analysis: (Business Overview, Market Share Analysis, Products/Services Offered, Recent Developments)

- 15.1 EnerSys

- 15.2 Exide India Limited

- 15.3 HBL

- 15.4 Saft

- 15.5 Amara Raja

- 15.6 GS Yuasa

- 15.7 Hoppecke